17 October 2024

How is your $50 per tonne spent?

Picture this: Your business is committed to sustainability, and you’re exploring carbon credits as part of your strategy. You’re about to invest $50 in a carbon removal credit, but the question lingers—where exactly does this money go?

Behind that transaction is a deeper story, one that connects your business funding with global environmental impact and local communities. To understand where your money goes and what routes it takes, let us set the scene at a South American rural community that currently serves as a development site for nature-based (NbS) projects. Since a lot of our projects take place in the Global South, here's a closer look at how your $50 is divided and the real impact it creates at grassroots level.

For the purpose of this article, all figures are ballpark estimates; these will of course vary from project to project—however the rough distribution tends to follow this pattern. As an aside, this breakdown is specifically for the cost per credit; stay tuned to find out how your investments and direct funding can help getting developers and nature based projects off the ground.

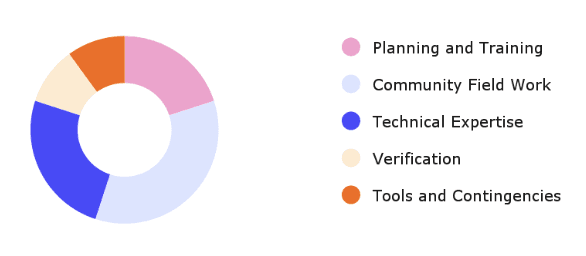

Planning and training checks: Laying the foundation (20%)

Our journey begins in a small rural community. Local leaders, developers, and experts gather to discuss how they can remove carbon emissions while improving their livelihoods. At this stage, meetings have been held, strategies developed, and community members trained in carbon monitoring and sustainable practices.

To get the project operational, local perspectives and knowledge must be incorporated into strategy to foster equal partnerships. This requires regular check-ins to make sure the plans are being implemented as designed. Here, 20% of your $50—around $10—goes towards verifying the project’s progress and supporting the local training needed to keep the project on track.

This phase is about more than just logistics—it's about creating a shared vision. Just like your business’s strategic planning, this step ensures everyone involved in developing and running the carbon project understands the goals and has the tools to succeed.

Community field work: The heart of the project (35% - 50%)

From the meeting room and agreement discussions, we move into the field. Equipped with GPS units, tape measures, and notebooks, community members head out to assess carbon levels in the forest. These local experts assess nature's ongoing carbon sequestration to verify the progress of carbon removal efforts. Here’s where 35% of your $50—$17.50—really makes a difference. These locals are not passive beneficiaries; they are key players, using their deep knowledge of their environment to measure carbon stocks and monitor biodiversity.

This stage is the boots-on-the-ground effort. Just as field teams in your business deliver data and insights that then drive decision-making and business strategy, these community members provide crucial information that drives the project forward.

Behind the scenes: Technical expertise and verification (25% + 10%)

As the community conducts data collection, technical experts step in. They ensure the project meets international standards, verifying that the carbon reductions are real and measurable. A significant 25% of your $50—$12.50—goes towards this MRV expertise, much like how you would hire consultants to oversee a complex business project.

Then, a third-party auditor verifies the project, ensuring credibility. For 10% of your investment, this process guarantees that your carbon credits are legitimate, much like having an external audit to ensure your financial reporting is accurate.

Equipment and flexibility: Tools and contingencies (10%)

Fieldwork doesn’t happen without the right tools. Imagine the GPS units, transportation, and essentials needed for teams to operate in remote areas. 10% of your investment—$5—covers these essentials. Meanwhile, 10% is reserved as a cost buffer, ensuring the project can continue smoothly even when unexpected challenges arise.

In business, you allocate resources for unexpected events. Similarly, this buffer guarantees operational continuity, even if costs rise or conditions change.

Recommendations for community benefit: Understanding the bigger picture

After fieldwork and MRV validation, the broader framework needs to be maintained. A smaller portion of your investment (~ 1% to 5%) covers the administrative costs, including legal agreements with developers and stakeholders. For example, this would cover categories like issuance fees to registries like Verra, puro.earth.

But perhaps the most impactful part of your investment is this: between 35% and 50% (i.e. $17 and $25 in this example) of every carbon credit sold is returned directly to the community. We recommend the latter; at least 50% of your $50 going back directly into the community to support ongoing planting operations and sustainable development. This ensures that local people strongly benefit financially from their efforts to protect the environment, and are justly compensated. Just as your business rewards performance, this system ensures that communities are directly invested in the project’s success.

A global investment with local impact

At the end of this journey, your $50 investment is no longer just a number. It’s funding training and fieldwork, empowering local communities, ensuring expert oversight, and maintaining the integrity of the entire process. Most importantly, it’s creating a ripple effect—helping to protect both the planet and the people on the front lines.

Here at Opna, we believe our actions can drive real change. In order to maximise positive impact, we prioritise allocating a larger share of the budget towards project developers. By breaking down carbon accounting to its essentials and verifying each subcategory, Opna enables corporates to showcase the impact of their climate contributions with confidence and trust. We ensure that the proceeds from the credits you purchase are distributed equitably, with as much funding as possible going to on-the-ground impact and accelerating the carbon removal processes we so urgently need to ensure climate justice for all.

To learn more about carbon credits or anything else within the carbon markets, reach out to our team at hi@opna.earth.

All figures/estimates above were provided by Andrew Holden CFA, Opna’s Advisor